Real estate investing continues to be one of the most reliable wealth-building strategies, even in a challenging interest rate environment. With recent market shifts creating new opportunities and obstacles, understanding current data and trends is crucial for making informed investment decisions. This comprehensive guide provides actionable insights based on the latest market research and statistics.

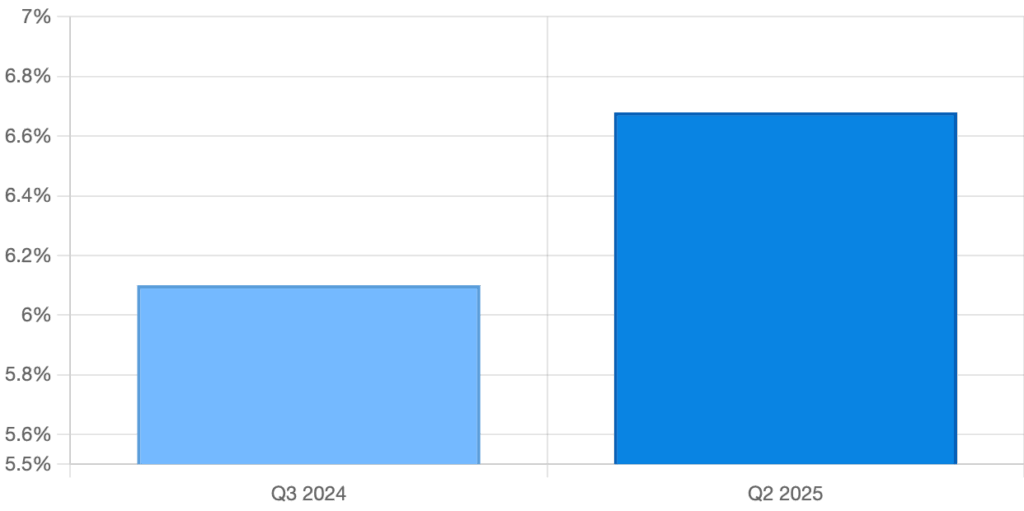

Rental Yield Trends: Q3 2024 vs Q2 2025

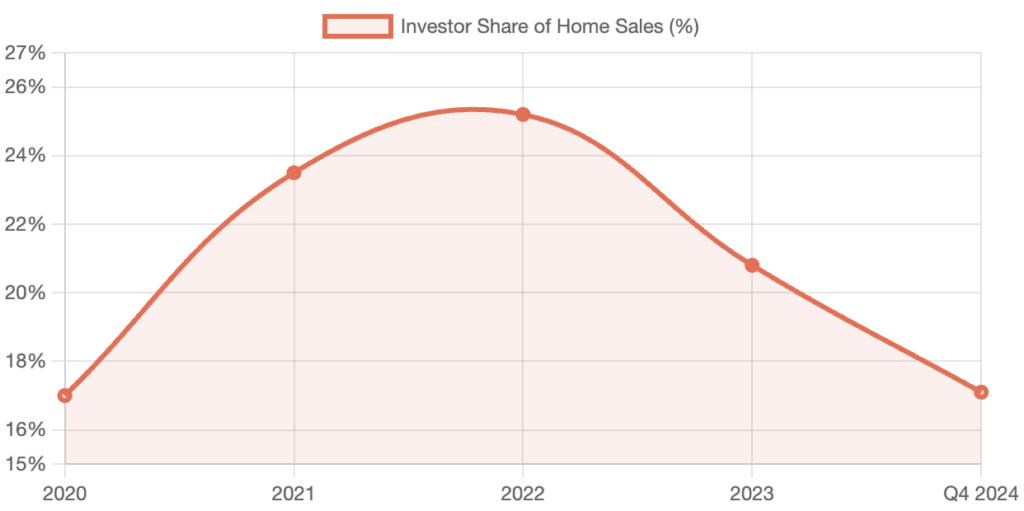

Investor Purchase Activity Over Time

Current Market Landscape: What the Data Shows

The real estate investment landscape in 2025 presents a mixed but increasingly optimistic picture. According to CBRE’s 2025 outlook, economic growth and firming real estate fundamentals are driving a moderate recovery in investment activity, even with 10-year Treasury yields remaining above 4%. This environment creates unique opportunities for strategic investors.

Key Market Statistics for 2025

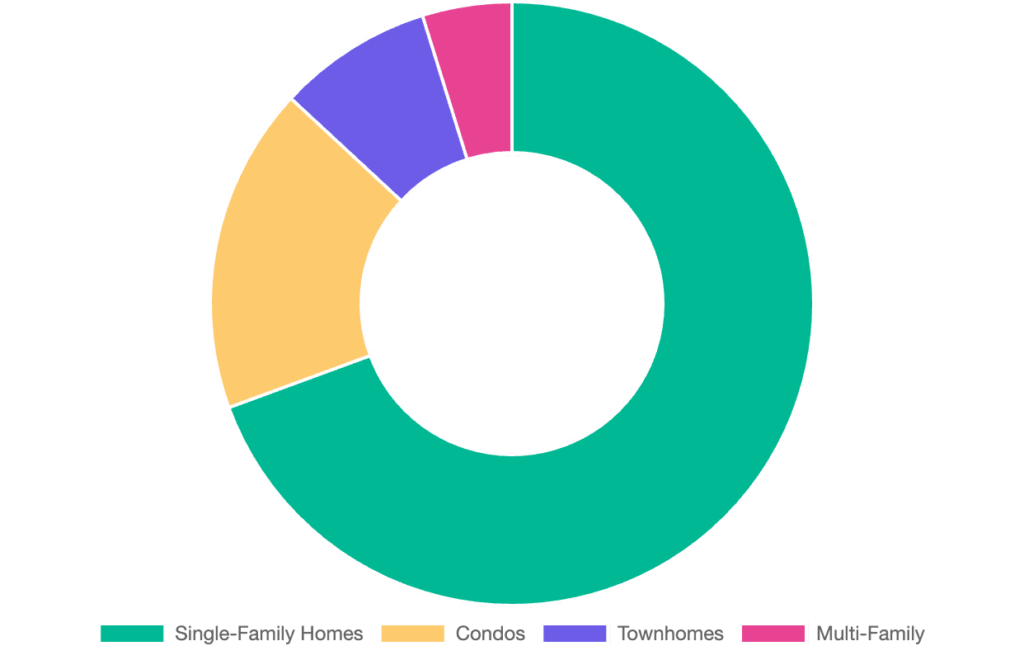

Property Type Distribution Among Investors

Investment Strategy Framework: Four Core Approaches

1. Buy-and-Hold Rental Properties

This traditional strategy involves purchasing properties to generate rental income while building long-term equity. Current market conditions make this particularly attractive.

Actionable Steps:

- Target markets with rental yields above the national average of 6.68%

- Focus on single-family homes, which represent 69.4% of investor purchases for good reason

- Calculate both gross and net rental yields before purchasing

- Consider properties priced below recent peaks to maximize yield potential

2. Fix-and-Flip Strategy

This approach involves purchasing undervalued properties, renovating them, and selling for profit. Market conditions in 2025 require careful analysis.

3. Real Estate Investment Trusts (REITs)

REITs offer exposure to real estate without direct property ownership, providing liquidity and diversification.

4. Commercial Real Estate Investment

Commercial properties offer higher income potential but require more capital and expertise.

Regional Market Analysis and Selection Criteria

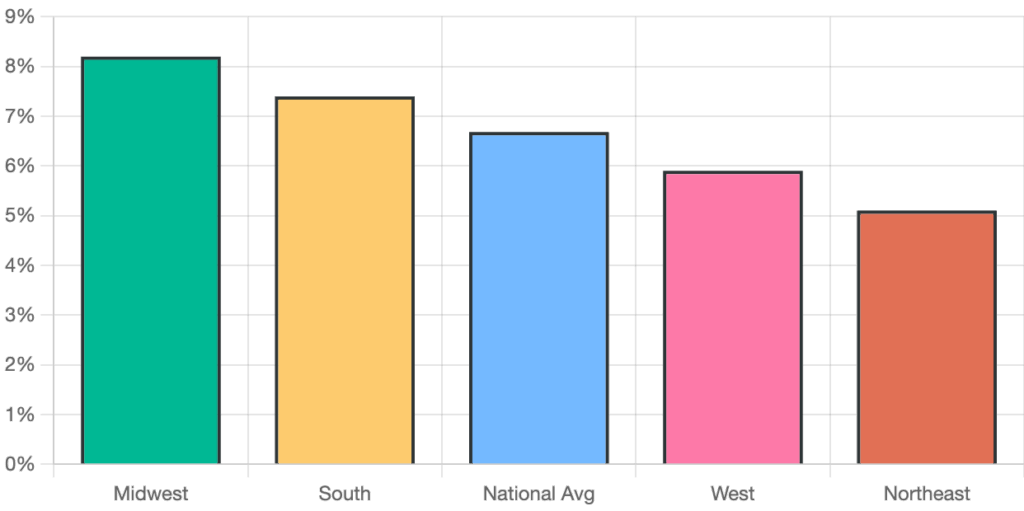

Regional Rental Yield Comparison

High-Yield Markets to Consider

Current data shows significant regional variations in rental yields and investment potential. Successful investors focus on markets with strong fundamentals rather than just high prices.

Market Selection Criteria:

- Population growth above national average

- Diverse economic base reducing single-industry risk

- Rental yields above 6.68% national average

- Reasonable price-to-rent ratios

- Strong local employment growth

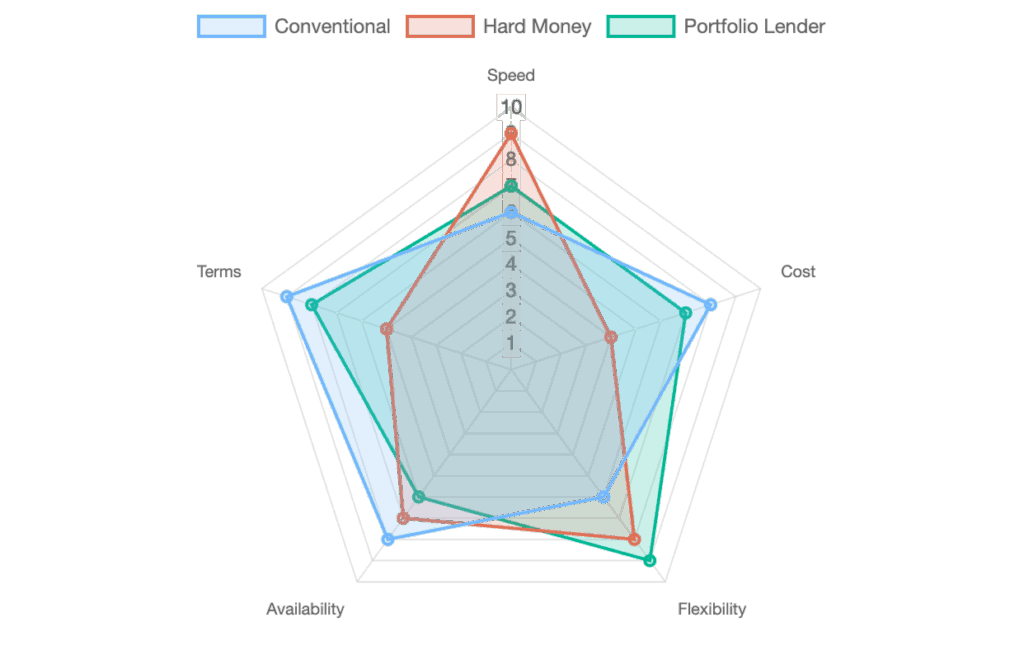

Financial Strategies and Funding Options

Financing Options Comparison

Conventional Financing in 2025

With mortgage rates for investors ranging from 7-8%, traditional financing requires careful cash flow analysis.

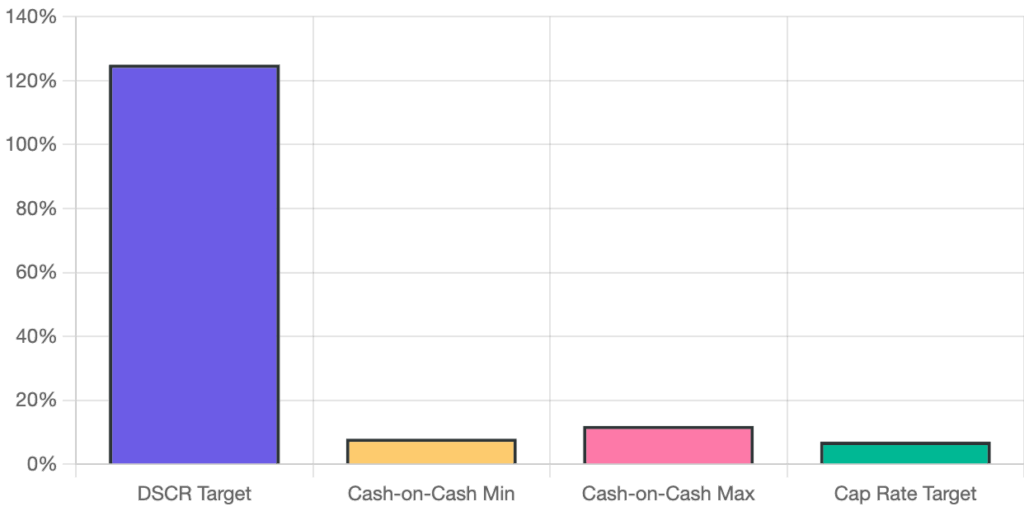

Key Financial Metrics Targets

Key Financial Metrics:

- Debt Service Coverage Ratio: Aim for 1.25x or higher

- Cash-on-Cash Return: Target 8-12% in current environment

- Cap Rate Analysis: Compare to 10-year Treasury yield plus risk premium

Alternative Financing Methods:

- Portfolio Lenders: More flexible terms for experienced investors

- Private Money: 10-15% rates but faster closing

- Seller Financing: Increasingly relevant option

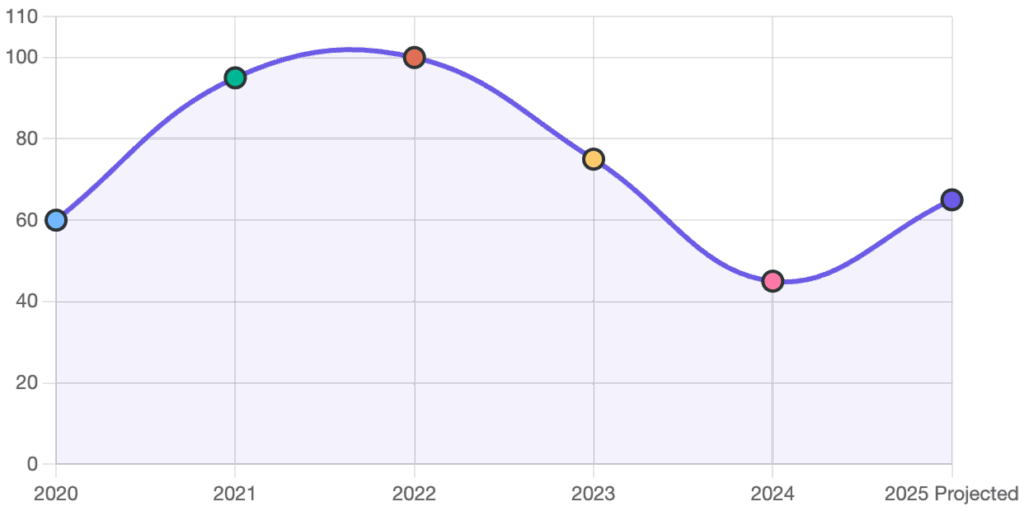

Market Timing and Economic Cycles

Real Estate Market Cycle Analysis

Current Cycle Position

The real estate market appears to be transitioning from a challenging 2022-2024 period toward gradual recovery in 2025. Understanding cycle positioning helps inform strategy timing.

- Inventory levels beginning to normalize

- Price appreciation moderating to sustainable levels

- Investment activity at cycle lows, suggesting opportunity

- Rental demand remaining strong despite economic headwinds

Risk Management and Due Diligence

Market Risk Assessment

Current market conditions require enhanced due diligence given economic uncertainties and higher interest rates.

Essential Analysis Points:

- Local employment diversity and growth trends

- Rental market strength and vacancy rates

- Property tax trends and municipal financial health

- Insurance costs and availability

- Exit strategy viability in different market scenarios

Conclusion: Actionable Next Steps

Real estate investing in 2025 requires adapting to higher interest rates while capitalizing on improved rental yields and reduced competition. The data shows clear opportunities for informed investors who focus on fundamentals rather than speculation.

Immediate Action Plan:

- Analyze Your Financial Position: Ensure adequate capital for 20-25% down payments plus reserves

- Research Target Markets: Focus on areas with rental yields above 6.68% and strong employment growth

- Build Your Professional Team: Establish relationships with investor-focused professionals

- Start Small and Scale: Begin with single-family rentals in familiar markets before expanding

- Develop Systems: Create standardized processes for analysis, acquisition, and management

- Focus on cash flow over appreciation in current environment

- Maintain conservative underwriting standards

- Build strong local market knowledge

- Develop multiple exit strategies for each investment

- Stay informed with reliable market data rather than speculation

The real estate investment landscape of 2025 rewards prepared, systematic investors who understand current market dynamics. With rental yields at multi-year highs and competition at cycle lows, opportunities exist for those who approach investing with proper research, adequate capital, and realistic expectations.