Introduction to Workforce Housing

Workforce housing refers to residential properties designed to be affordable for middle-income households, typically those earning between 60% and 120% of the Area Median Income (AMI) Progress and Poverty Institute. This segment of the population often includes essential community workers such as teachers, healthcare professionals, first responders, retail clerks, and builders Progress and Poverty Institute. The core idea is to provide quality housing options for individuals and families who are gainfully employed but whose income is insufficient to secure market-rate housing in reasonable proximity to their workplaces Wikipedia. It occupies a critical space between subsidized affordable housing and luxury housing DoorLoop.

Crucially, workforce housing is distinct from general affordable housing programs, which typically serve households earning at or below 60% of the AMI Progress and Poverty Institute. While both address housing affordability, workforce housing targets a demographic often termed the “missing middle”—those who earn too much to qualify for traditional subsidies but not enough to afford escalating market-rate rents or home prices, especially in or near major employment centers.

The “Missing Middle” Crisis

The United States is currently grappling with a significant challenge: a widening chasm between the wages of middle-income earners and the escalating cost of quality housing, particularly in locations close to employment opportunities. This “missing middle” crisis has profound implications. As housing prices soar beyond the reach of many early-career workers and young families, the median age for first-time homebuyers has increased, and wealth-building through homeownership is delayed Milken Institute. National data indicates a substantial shortage of listings affordable to middle-income buyers, even as overall housing inventory shows some growth National Association of Realtors (NAR) – Housing Affordability and Supply.

The consequences of this gap are far-reaching. Individuals face burdensome commutes and diminished quality of life. Communities struggle with recruitment and retention of essential workers, leading to impacts on local services and economic vitality. For instance, businesses in various sectors, including service and resort industries, may be forced to cut hours or struggle to find staff due to the lack of attainable housing for their employees Planning.org blog.

Article’s Core Question & Roadmap

This article delves into a critical question: How can revitalizing workforce housing align the pressing demand for affordable, quality homes with sustainable investment strategies to create long-term, mutual value for both families and investors?

To address this, the subsequent sections will explore:

- The characteristics and challenges of the “missing middle” demographic.

- The multifaceted approaches to revitalizing workforce housing.

- A deep dive into strategies for aligning housing demand with sustainable investment, focusing on financial models, ESG integration, and value creation mechanisms.

- Illustrative case studies of successful workforce housing revitalization projects.

- Common hurdles in these endeavors and strategies to overcome them.

- The path forward, including emerging trends, policy recommendations, and a call to action for stakeholders.

By examining these dimensions, this report aims to provide a comprehensive understanding of how thoughtful revitalization and investment can transform the workforce housing landscape, fostering more equitable and prosperous communities.

Understanding the Demand: The Plight of the “Missing Middle”

The “missing middle” refers to a growing cohort of individuals and families who are essential to the functioning of our communities yet find themselves increasingly priced out of the housing market. Understanding their profile and the scale of the affordability gap is crucial to appreciating the urgency of workforce housing solutions.

Profiling the Workforce

The workforce in need of such housing comprises individuals in vital community and business roles. These often include teachers, police officers, firefighters, healthcare workers (such as nurses), builders, and retail clerks Progress and Poverty Institute. While gainfully employed, their income levels, typically falling within the 60% to 120% AMI range, often lag behind the rapid appreciation of housing costs in desirable areas. For example, a household earning $75,000 annually, which might include teachers or skilled trades workers, faces significant limitations in housing choices NAR – Housing Affordability and Supply. The shrinking of the American middle class over the past five decades, with a decrease from 61% of adults in 1971 to 50% in 2021, further underscores the economic pressures on this demographic Pew Research Center.

The Scale of the Affordability Gap

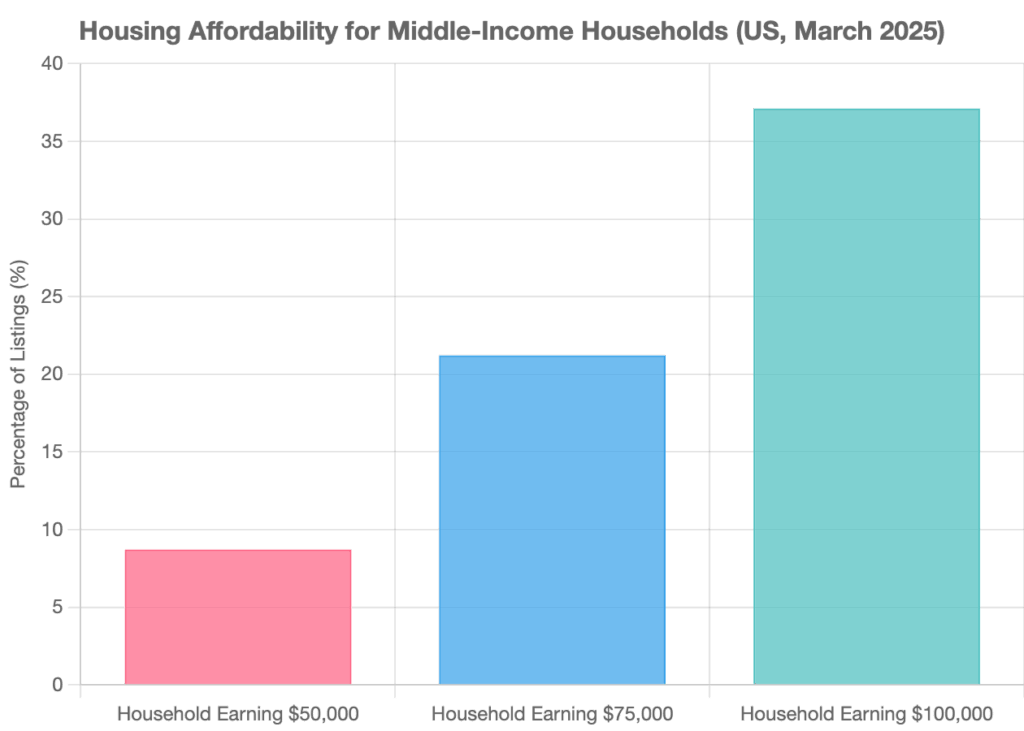

The shortage of housing affordable to middle-income households is substantial. According to the National Association of Realtors, as of March 2025, households earning $75,000 a year could afford only 21.2% of active listings, while those earning $100,000 annually could afford 37.1% of listings. For households earning $50,000, a mere 8.7% of listings were within reach NAR – Housing Affordability and Supply. This starkly contrasts with 2019, when moderate-income buyers could afford almost half the homes on the market Governing.com. The National Low Income Housing Coalition (NLIHC) reports a national shortage of over 7.1 million rental homes affordable and available to extremely low-income renters, and while workforce housing targets a higher income band, the overall pressure on housing supply affects all segments NLIHC – The Gap. Furthermore, in 2023, 31.3% of American households were cost-burdened, spending more than 30% of their income on housing; this figure rises to 49.7% for renter households Pew Research Center

Percentage of U.S. Home Listings Affordable by Household Income (March 2025). Source: www.nar.realtor

Consequences of Inadequate Workforce Housing

For Individuals & Families

The lack of affordable workforce housing places significant burdens on individuals and families. Many are forced to spend more than 30% of their income on housing, classifying them as “cost-burdened” Pew Research Center. This financial strain limits their ability to save, invest, or cover other essential expenses. Consequently, wealth-building, often achieved through homeownership, is delayed or becomes unattainable Milken Institute. To find affordable options, many endure long commutes, which detract from family time, increase transportation costs, and reduce overall quality of life.

For Communities & Economies

The repercussions extend to the broader community and economy. Essential service sectors, such as education, healthcare, and emergency services, face labor shortages as workers cannot afford to live near their jobs Estero Today. This can lead to reduced service quality and availability. In areas reliant on tourism or service industries, businesses may be forced to curtail operating hours due to staffing challenges directly linked to housing unavailability Planning.org blog. Ultimately, communities risk losing vital residents and families who contribute to their social, cultural, and economic fabric, thereby hindering overall economic growth and prosperity Golden Shovel Agency.

Revitalizing Workforce Housing: Pathways to Renewal

Addressing the workforce housing shortage requires a multifaceted approach that goes beyond simply constructing new buildings. Revitalization encompasses a range of strategies aimed at increasing the supply of quality, affordable homes by leveraging existing assets and thoughtfully integrating new developments into the community fabric.

Defining Revitalization

Workforce housing revitalization is a comprehensive process focused on improving and expanding housing options for the “missing middle.” This involves more than just new builds; key strategies include:

- Rehabilitation of existing, aging housing stock: Upgrading older buildings to meet modern safety, accessibility, and energy efficiency standards, thereby preserving affordable units that might otherwise be lost to deterioration or market-rate conversion. Examples include projects like the rehabilitated affordable housing in Tonopah, Nevada, contributing to the town’s revitalization HUD User – Community Development Case Studies.

- Adaptive reuse of underutilized buildings: Transforming non-residential or obsolete structures—such as historic mills, vacant factories, or outdated commercial properties—into residential units. This approach can preserve architectural heritage while creating unique living spaces. The transformation of a contaminated factory site in Manitowoc, WI, into workforce housing is a prime example of adaptive reuse combined with urban renewal Farmonaut. Similarly, projects like the Villas at the Ridgeway in Yonkers, NY, involved redeveloping derelict public housing buildings BDC Network.

- Infill development: Strategically constructing new housing on vacant or underused parcels within existing neighborhoods. This can increase density in appropriate locations, make use of existing infrastructure, and enhance neighborhood vitality.

Key Objectives of Revitalization

The overarching goals of workforce housing revitalization efforts are to:

- Improve housing quality and safety: Ensuring that residents have access to decent, well-maintained homes that meet contemporary standards.

- Enhance energy efficiency and sustainability: Reducing utility costs for residents and the environmental footprint of buildings through green building practices and retrofits.

- Preserve community character while increasing density where appropriate: Balancing the need for more housing with the desire to maintain the unique attributes of existing neighborhoods.

- Integrate housing with community amenities and transportation: Creating livable communities where residents have convenient access to jobs, schools, services, and public transit.

Initial Considerations for Revitalization Projects

Successful revitalization projects begin with careful planning and assessment. Key initial considerations include:

- Site assessment and community needs analysis: Evaluating the suitability of potential sites, understanding the specific housing needs of the local workforce, and assessing existing infrastructure capacity.

- Understanding the local zoning and regulatory landscape: Navigating zoning ordinances, building codes, and permitting processes, which can significantly impact project feasibility and timelines The Peebles Corporation.

These foundational steps are crucial for developing revitalization strategies that are both impactful and contextually appropriate, paving the way for the alignment of housing demand with sustainable investment.

Aligning Demand with Sustainable Investment: Creating Mutual Long-Term Value

The core challenge and opportunity in workforce housing lies in aligning the acute demand for affordable, quality homes with investment strategies that are not only financially viable but also environmentally sound and socially responsible. This alignment is key to creating lasting value for both the families who inhabit these homes and the investors who fund their development and revitalization.

The Philosophy: Sustainable Investment in Workforce Housing

Sustainable investment in workforce housing transcends traditional profit-driven models by integrating financial objectives with positive social and environmental outcomes. It’s a recognition that long-term value is intrinsically linked to the well-being of residents and the health of communities CCM Investment Management (via PDF title). This approach is increasingly framed through Environmental, Social, and Governance (ESG) criteria Urban Land Institute (ULI) – Investing for Impact.

- Environmental: This involves developing and retrofitting properties with a focus on energy efficiency (e.g., better insulation, efficient HVAC systems, LED lighting), water conservation, use of sustainable or recycled materials, renewable energy installations (like solar panels), and proximity to public transportation to reduce reliance on cars ULI – Investing for Impact.

- Social: The social component prioritizes creating safe, healthy, and inclusive living environments. This extends to providing valuable resident services such as childcare, after-school programs, job training, financial literacy workshops, and health services. An example is Comunidad Partners’ initiative to offer residents free credit-building tools like Esusu, which reports on-time rent payments to credit bureaus, helping residents build positive credit histories Multi-Housing News – Comunidad Partners example. Ensuring long-term affordability and enhancing overall resident well-being are paramount.

- Governance: Strong governance practices include transparent operational procedures, meaningful community engagement throughout the development and management phases, and ethical management committed to resident satisfaction and fair housing practices.

A hallmark of sustainable investment in this sector is a long-term horizon. Unlike speculative ventures, these investments focus on stable, resilient assets that provide consistent returns while addressing a fundamental societal need Forbes – Strength of Workforce Housing.

Financial Models and Investment Strategies for Revitalization (60-120% AMI Focus)

Successfully revitalizing and developing workforce housing for the 60-120% AMI bracket often requires innovative financial structuring and collaborative partnerships.

Public-Private Partnerships (PPPs)

PPPs are crucial for bridging financial gaps and mitigating risks inherent in developing housing that is affordable to middle-income earners. These collaborations leverage the unique strengths of various stakeholders:

- Government (Local, State, Federal): Can contribute by providing publicly owned land at low or no cost, offering tax incentives (such as property tax abatements or Tax Increment Financing), awarding density bonuses that allow for more units on a given site, streamlining permitting processes, investing in necessary infrastructure upgrades, and providing direct funding through grants or low-interest loans. Examples include Florida’s Live Local Act, which offers tax exemptions and zoning preemption for qualifying affordable and workforce housing projects Multi-Housing News – Live Local Act Florida.

- Non-Profit Developers: Bring a mission-driven focus, deep community ties, expertise in navigating affordable housing finance, and a commitment to long-term ownership and management. They often have access to specific philanthropic or government funding streams not available to for-profit entities CRE.org – Non-profits and Local Governments.

- For-Profit Developers: Contribute development expertise, construction management skills, operational efficiency, and access to private capital markets.

- Investors/Financial Institutions: Provide essential equity and debt financing. Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac play a significant role. Fannie Mae’s Sponsor-Dedicated Workforce (SDW) initiative, for example, offers creative financing for conventional properties where owners restrict rents on at least 20% of units to be affordable for those earning up to 80% AMI Globest.com. Both Fannie Mae and Freddie Mac have programs (e.g., Fannie’s Sponsor-Initiated Affordability (SIA) and Freddie’s Workforce Housing Preservation) that provide pricing and underwriting flexibility to incentivize the creation or preservation of units affordable to residents earning between 80% and 120% of AMI Multi-Housing News – Fannie Mae/Freddie Mac programs.

Impact Investing Models

A growing number of investment funds and vehicles are specifically targeting workforce housing with the dual objective of generating competitive financial returns alongside measurable social and environmental impact Rose Companies – Making an Impact. Community Development Financial Institutions (CDFIs) are key players, channeling private investment into underserved communities and projects that might not attract conventional financing. Philanthropic organizations are also launching impact investment funds to support workforce housing production National Housing Crisis Task Force (via PDF title for local philanthropy tool).

Innovative Financing Mechanisms

A layered financing approach is often necessary:

- Tax-Exempt Bonds: Can provide lower-cost debt financing for affordable housing projects.

- Low-Income Housing Tax Credits (LIHTC): While primarily for units below 60% AMI, LIHTC can be a critical component in mixed-income developments that include workforce housing tiers, helping to cross-subsidize the overall project Global Projects View.

- New Markets Tax Credits (NMTCs): Can support projects, including mixed-use developments with a housing component, in economically distressed communities.

- Opportunity Zone Funds: Offer tax incentives for investments in designated low-income census tracts, potentially attracting equity for workforce housing.

- Commercial Property Assessed Clean Energy (C-PACE): Provides long-term, fixed-rate financing for energy efficiency, renewable energy, and water conservation upgrades in commercial (including multifamily) buildings, which can be incorporated into the capital stack for revitalization projects Multi-Housing News.

Role of Anchor Institutions

Large, stable employers like universities, hospitals, and major corporations have a vested interest in ensuring their workforce can afford to live nearby. These anchor institutions can play a vital role by:

- Contributing land they own for housing development.

- Master leasing blocks of units for their employees.

- Providing direct financial support or loan guarantees.

- Partnering with developers or undertaking direct development of workforce housing projects J.P. Morgan – Workforce Housing for Higher Education.

Delivering Long-Term Value for Families and Residents

Sustainable and revitalized workforce housing delivers profound, lasting benefits to the families and individuals who call these communities home.

- Enhanced Affordability & Financial Stability: With rents typically capped at a percentage of AMI (often 30%), residents experience a reduced housing cost burden. This predictability in housing expenses allows for better household budgeting, increased savings, and a stronger financial footing. Programs like Esusu, which report on-time rent payments to credit bureaus, can further empower residents by helping them build positive credit histories, a key step towards broader economic mobility Multi-Housing News – Esusu example.

- Improved Quality of Life: Revitalization projects often mean access to safe, decent, and well-maintained homes, frequently featuring modern amenities and energy-efficient systems. This translates to healthier living environments, with better indoor air quality and reduced exposure to hazards often found in older, unrenovated buildings. Crucially, workforce housing aims for proximity to employment centers, significantly reducing commute times and associated costs, freeing up time for family, education, or leisure.

- Stronger, More Stable Communities: Stable, affordable housing contributes to lower resident turnover, fostering greater neighborhood stability and social cohesion. These developments are often situated in or help create communities with better access to quality schools, healthcare facilities, parks, and other essential amenities. By design, many workforce housing projects contribute to the development of diverse, mixed-income neighborhoods, which can offer enhanced social and economic opportunities for all residents Local Housing Solutions – mixed-income housing.

- Sense of Security and Belonging: Ultimately, secure and affordable housing provides a foundational sense of stability and belonging, which is essential for individual, family, and child well-being. It allows residents to put down roots, engage more fully in their communities, and plan for the future with greater confidence.

Generating Long-Term Value for Investors

Investing in workforce housing, particularly through sustainable revitalization strategies, offers compelling long-term value propositions for investors.

- Stable and Resilient Returns: The persistent and growing demand from the “missing middle” ensures consistently high occupancy rates and a steady, reliable cash flow Forbes and Multi-Housing News – Why Workforce Housing Works. Compared to market-rate or luxury housing, workforce housing typically experiences lower turnover rates, which translates to reduced operational costs associated with marketing, unit preparation, and vacancies Multi-Housing News – Bob Simpson quote. This asset class also demonstrates resilience during economic downturns, as the need for affordable housing options often increases during such periods PPR Capital Management.

- Market Opportunity and Scalability: Workforce housing addresses a significant and underserved segment of the housing market, with an estimated 7 million existing workforce housing units nationally, indicating substantial room for investment and growth Multi-Housing News. This offers investors opportunities for portfolio diversification into a needs-driven sector.

- Value Creation through Revitalization & Operations: Acquiring and modernizing undervalued or aging assets presents a clear path to value creation. Implementing operational efficiencies, such as energy and water-saving retrofits (often financed through mechanisms like C-PACE), can lead to lower utility expenses and an improved Net Operating Income (NOI) ULI – Investing for Impact. Physical improvements, coupled with professional management and resident-focused services, enhance the property’s overall value and attractiveness.

- Alignment with ESG Mandates: There is a rapidly growing pool of capital from institutional investors, pension funds, and endowments seeking investments that meet robust Environmental, Social, and Governance (ESG) criteria ULI – Investing for Impact. Workforce housing, especially when developed or revitalized with sustainability in mind, aligns perfectly with these mandates and can satisfy corporate social responsibility (CSR) goals Deloitte – ESG as value driver. Sustainable properties may also benefit from a “green premium” or be perceived as lower risk by insurers and lenders ULI – Investing for Impact.

- Positive Community Relations and Reduced Regulatory Risk: Investments that demonstrably contribute to community well-being by addressing critical housing needs can foster goodwill and lead to smoother relationships with local authorities and community groups. By aligning with public policy goals, these projects may encounter a more favorable regulatory environment and greater opportunities for partnership.

Key Takeaways: Aligning Demand and Sustainable Investment

- Philosophy: Sustainable investment in workforce housing integrates financial returns with positive social and environmental outcomes, guided by ESG principles.

- Financial Models: Public-Private Partnerships are vital, leveraging government support (land, incentives), non-profit expertise, developer efficiency, and specialized financing from institutions like Fannie Mae and Freddie Mac. Impact investing and innovative mechanisms like C-PACE and tax credits fill funding gaps.

- Value for Families: Delivers enhanced affordability, financial stability (through predictable costs and services like credit building), improved quality of life (safe, healthy homes, reduced commutes), and stronger, more stable communities.

- Value for Investors: Offers stable and resilient returns (high occupancy, low turnover), addresses a large underserved market, creates value through revitalization and operational efficiencies (especially green retrofits), and aligns with growing ESG investment mandates.

Case Studies: Workforce Housing Revitalization in Action

The following case studies illustrate how the revitalization of workforce housing can successfully align the need for affordable, quality homes with sustainable investment strategies, creating tangible value for residents, investors, and the broader community.

1. Manitowoc Mirro Site Redevelopment (Manitowoc, WI)

Project Overview: The Manitowoc Mirro Site project involves the transformation of a long-abandoned, contaminated former aluminum factory site into a vibrant workforce housing development. The plan includes 59 workforce housing units with income-based costs, targeting essential workers in the city Farmonaut and NBC26 News.

The Challenge & Opportunity: The primary challenge was the environmental contamination of a large brownfield site in a key downtown area, which had been vacant since 2003. The opportunity lay in remediating the site to address a critical local housing shortage, stimulate urban renewal, and provide affordable options for the city’s workforce.

Revitalization Strategy & Financial Model: The project is a significant urban revitalization effort involving comprehensive site remediation (removal of contaminated soil, demolition of old structures) funded in part by a nearly $2 million federal infrastructure grant. The city partnered with a developer who intends to apply for affordable housing tax credits. This public-private collaboration is key to the project’s financial feasibility.

Value Created for Families/Residents: The project will provide 59 new, quality housing units affordable to the local workforce, enabling them to live closer to their jobs. This addresses a direct housing need and contributes to improved quality of life by redeveloping a blighted area into a safe, habitable community.

Value Created for Investors/Developers: For the developer, the project offers an opportunity to develop in-demand housing with public support (grants, potential tax credits), mitigating some financial risks. The ESG impact is significant, particularly the environmental cleanup and social benefit of providing workforce housing.

Broader Community Impact: This initiative is a cornerstone of Manitowoc’s commitment to sustainable urban planning. It removes an environmental hazard, creates jobs (construction and ongoing management), expands the local tax base, and is expected to attract new residents and stimulate local economic growth, revitalizing a key part of the city Farmonaut.

2. Lineage (Alexandria, VA)

Project Overview: Lineage is a redevelopment project in Alexandria’s historic Parker-Gray District. It replaced 15 dilapidated public housing units (Ramsey Homes, originally built in 1942 for African-American war industry workers) with a new four-story building containing 52 mixed-income apartments. These units serve households earning between 30% and 60% of AMI BDC Network and ALXNow.

The Challenge & Opportunity: The original precast modernist units were deemed beyond repair. The challenge was to redevelop the site in a historically sensitive manner while significantly increasing the number of affordable units. The opportunity was to provide modern, safe, and energy-efficient housing for low- to moderate-income residents in a high-opportunity area.

Revitalization Strategy & Financial Model: The Alexandria Redevelopment and Housing Authority (ARHA) led the project, securing tax credit financing and a $2 million loan from the city ALXNow. The KTGY-led design team leveraged FAR requirements to increase density on the 0.71-acre site. The project achieved EarthCraft Gold certification for sustainability BDC Network.

Value Created for Families/Residents: Lineage provides 52 high-quality, affordable homes (15 at 30% AMI, 11 at 50% AMI, and 26 at 60% AMI), including six fully accessible units. Residents benefit from modern amenities, energy-efficient design (reducing utility costs), and proximity to community resources like the Charles Houston Recreation Center and the Alexandria Black History Museum ALXNow.

Value Created for Investors/Developers (ARHA & City): The project successfully replaced obsolete housing with a greater number of sustainable, affordable units, meeting a critical community need. The use of tax credits and city funding made the project financially viable. The EarthCraft Gold certification enhances its long-term operational efficiency and ESG profile.

Broader Community Impact: The project revitalized an important site within a historic district, providing much-needed affordable housing without displacing the community’s heritage. It demonstrates a commitment to inclusive development and addresses concerns about density and historic preservation through thoughtful design.

3. Villas at the Ridgeway (Yonkers, NY)

Project Overview: This redevelopment project in Southwest Yonkers replaced three derelict public housing buildings (Cottage Place Gardens) with 70 new, mixed-income apartments. The units range from two- to four-bedrooms, serving households at 30%, 50%, and 60% AMI, alongside some market-rate units BDC Network. The development is LEED certified New York Housing Conference (NYHC).

The Challenge & Opportunity: The existing public housing was outdated and blighted. The challenge was to redevelop the site to provide high-quality, modern housing and contribute to the broader revitalization of Southwest Yonkers. The opportunity was to create a mixed-income community that would deconcentrate poverty and improve living conditions.

Revitalization Strategy & Financial Model: The project was a partnership between The Community Builders, Inc. (TCB), a non-profit developer, and the Municipal Housing Authority for the City of Yonkers (MHACY). It utilized modular construction (40x16x10-foot units fabricated off-site) to potentially speed up construction and control costs BDC Network. The project aligns with local plans like the Yonkers Choice Neighborhoods Transformation Plan NYHC. Funding likely involved a mix of public housing authority resources, state/city funds, and potentially tax credits.

Value Created for Families/Residents: Residents now have access to new, energy-efficient (LEED certified) homes with improved amenities. The mixed-income nature of the development aims to create a more diverse and integrated community. The project also included the renovation of a neighborhood daycare center.

Value Created for Investors/Developers (TCB & MHACY): The partnership successfully transformed a problematic public housing site into a valuable community asset. The use of modular construction and LEED certification demonstrates innovation and a commitment to sustainability, enhancing the project’s long-term viability and appeal.

Broader Community Impact: The Villas at the Ridgeway is a key component in the revitalization of Southwest Yonkers. It aims to re-invigorate pedestrian activity through new sidewalks, street trees, and lighting, better connecting residents to their neighborhood and improving the overall sense of place NYHC.

Overcoming Hurdles: Navigating Challenges in Revitalization

Revitalizing workforce housing, while crucial, is fraught with challenges that require strategic navigation and collaborative solutions. Understanding these obstacles is the first step toward overcoming them.

Common Obstacles

- Financial Viability: The fundamental challenge is bridging the “gap” between the cost of developing or renovating housing and the rents that middle-income households can afford. Balancing deep affordability with project costs and reasonable investor returns is a constant tension Multi-Housing News – Workforce Housing Finance.

- Land Costs & Availability: In job-rich areas where workforce housing is most needed, land prices are often prohibitively high. The scarcity of suitable, affordable land parcels is a major constraint.

- Construction & Rehabilitation Costs: The rising costs of construction materials and skilled labor significantly impact project budgets. Renovating older structures can also uncover unforeseen expenses and complexities, such as hazardous material abatement or structural issues The Peebles Corporation and Chan Zuckerberg Initiative.

- Zoning & Regulatory Barriers: Restrictive zoning laws, such as minimum lot sizes, parking requirements, or prohibitions on multi-family housing in certain areas, can make it difficult or impossible to build denser, more affordable workforce housing. Lengthy and uncertain approval processes also add to costs and risks The Peebles Corporation and Stanford Social Innovation Review (SSIR.org).

- NIMBYism (“Not In My Backyard”): Community opposition, often fueled by misconceptions about affordable or workforce housing and its potential impact on property values or neighborhood character, can delay or derail projects.

- Complexity of Partnerships: Public-Private Partnerships (PPPs), while essential, involve aligning the diverse interests, timelines, and priorities of multiple stakeholders (government agencies, non-profits, private developers, community groups), which can be challenging.

Strategies for Mitigation

- Policy Advocacy & Reform: Advocating for and implementing policy changes such as inclusionary zoning (requiring a percentage of affordable units in new developments), density bonuses, streamlined permitting processes, and property tax abatements specifically for workforce housing projects.

- Innovative Construction & Design: Employing cost-saving construction methods like modular or prefabricated components, value engineering in design, and prioritizing adaptive reuse of existing structures to reduce material and site development costs.

- Creative Financing Stacks: Skillfully layering multiple sources of funding, including federal, state, and local government programs, private activity bonds, tax credits (LIHTC, NMTC), CDFI loans, philanthropic grants, and impact investments.

- Community Engagement & Education: Proactively engaging with communities from the early stages of project planning to address concerns, dispel myths, and highlight the benefits of workforce housing for the entire community (e.g., enabling essential workers to live locally, supporting local businesses).

- Strong Leadership & Collaboration: Establishing clear roles, responsibilities, shared goals, and transparent communication channels among all partners in a PPP. Strong project management and a commitment to collaborative problem-solving are crucial Convergent Nonprofit Solutions – Collaborative Strategies.

The Path Forward: Sustaining Momentum in Workforce Housing

Sustaining and scaling efforts to revitalize workforce housing requires continuous innovation, supportive policies, and a concerted commitment from all stakeholders. The landscape is evolving, presenting both new opportunities and ongoing challenges.

Emerging Trends & Innovations

- Increased Focus on ESG Metrics and Impact Reporting: The real estate investment world is placing greater emphasis on Environmental, Social, and Governance (ESG) performance. This trend is driving more capital towards workforce housing projects that can demonstrate tangible positive impacts alongside financial returns. Standardized frameworks for measuring and reporting these impacts are becoming more common.

- Technological Advancements: Innovations in construction technology, such as 3D printing, advanced prefabrication, and cross-laminated timber, hold the potential to reduce construction costs and timelines. In property management, technology is improving operational efficiency and resident experience through smart building systems and digital communication platforms.

- Growing Role of Institutional Investors: Recognizing the stable demand and resilient returns, more institutional investors are entering the workforce housing sector, bringing significant capital and sophisticated investment strategies Multi-Housing News – Why Workforce Housing Works.

- Greater Emphasis on Resident Services: There’s a growing understanding that providing supportive resident services (e.g., health and wellness programs, financial literacy, after-school care) is not just a social good but also a value-add component that can improve resident retention and community stability, ultimately benefiting investors.

Policy Recommendations

- Expansion and Enhancement of Funding Programs: Federal, state, and local governments should increase funding for programs that support workforce housing development and preservation. This includes expanding tax credit programs, direct subsidies, and low-cost financing options tailored to the 60-120% AMI range.

- Zoning and Land-Use Reforms: Localities should proactively reform zoning codes to allow for a greater variety of housing types (“missing middle housing” like duplexes, townhouses, small apartment buildings), increase allowable densities in appropriate locations (e.g., near transit), reduce minimum parking requirements, and streamline approval processes for projects that include workforce housing.

- Support for Capacity Building: Providing technical assistance and funding to support the capacity of non-profit developers and community-based organizations that often play a critical role in developing and preserving workforce housing.

Call to Action for Stakeholders

- Investors: Actively seek out and invest in sustainable workforce housing revitalization projects, recognizing the dual return potential (financial and social/environmental). Engage with developers and communities to understand local needs and opportunities.

- Developers (For-Profit and Non-Profit): Embrace innovative design and construction methods. Proactively form partnerships and engage with communities to build support and ensure projects meet local needs. Prioritize long-term sustainability and resident well-being.

- Policymakers: Champion and enact policies that create a supportive regulatory and financial environment for workforce housing. This includes zoning reform, dedicated funding streams, and incentives for sustainable development.

- Communities: Advocate for and welcome well-designed workforce housing as essential infrastructure that supports local economies and creates more inclusive, vibrant neighborhoods. Participate constructively in planning processes.

- Anchor Institutions: Leverage their resources (land, capital, influence) to facilitate the development of workforce housing for their employees and the broader community.

Conclusion: Revitalizing Workforce Housing for a Prosperous and Equitable Future

The imperative to address the housing needs of the “missing middle” is clear. Revitalizing workforce housing is far more than a construction endeavor; it represents a strategic and sustainable approach to aligning the critical demand for affordable, quality homes with investment principles that generate both financial returns and profound societal benefits. This alignment is not merely an aspiration but a demonstrable reality, as evidenced by successful projects across the nation.

By focusing on the revitalization of existing stock, adaptive reuse, and thoughtful infill development, coupled with sustainable investment strategies rooted in ESG principles, we can create lasting value. For middle-income families and essential workers, this means the stability of an affordable home, improved quality of life, reduced financial stress, and greater opportunities for economic advancement. For investors, it offers resilient returns, access to a large and underserved market, and the ability to meet growing mandates for socially responsible investment.

The broader societal impacts are equally significant. Thriving workforce housing contributes to economic vitality by ensuring that essential workers can live in the communities they serve, supporting local businesses, and reducing labor shortages. It fosters social equity by creating more diverse, mixed-income neighborhoods and mitigating the displacement pressures that can fragment communities. Ultimately, a robust workforce housing sector helps build more inclusive, resilient, and prosperous places for everyone to live and work.

The path forward requires unwavering commitment and enhanced collaboration among all stakeholders—investors, developers, policymakers, anchor institutions, and community members. By working in concert, championing innovation, and advocating for supportive policies, we can scale these solutions and ensure that every member of our workforce has a place to call home, strengthening the very fabric of our communities for generations to come.